DATEV Meine Steuern

Your digital tax advisor

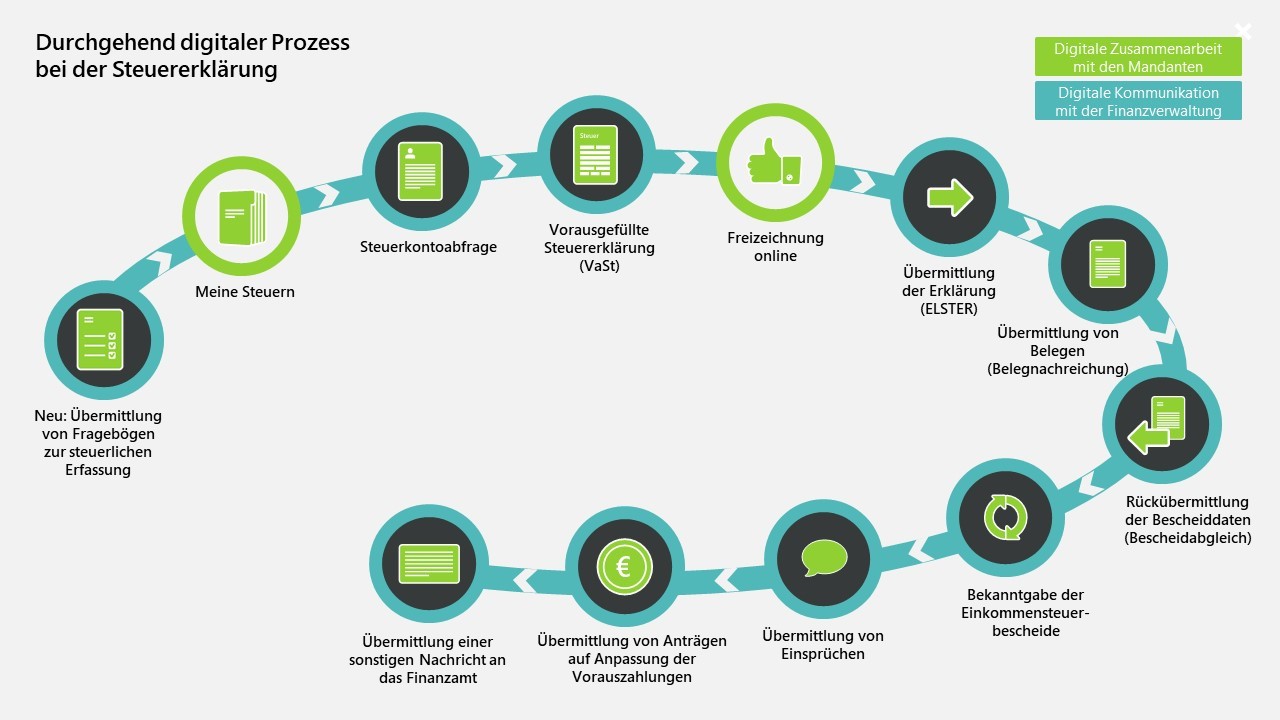

Digital cooperation for your tax return

The DATEV Meine Steuern online application supports efficient cooperation between the law firm and the client in all aspects of tax returns. The application complements the preparation process in a meaningful way and ensures an end-to-end digital process in preparing the tax return.

All necessary information and receipts are recorded by the client in DATEV Meine Steuern and made available to the firm digitally. The firm accesses this data with the DATEV Einkommensteuer program and prepares tax returns for your client on the basis of the information. The completed tax return can then be made available to the client digitally online via DATEV Freizeichnung.

Benefit from the advantages:

DATEV Meine Steuern: Exchange documents